Experts Project Home Prices Will Rise over the Next 5 Years

Experts Project Home Prices Will Rise over the Next 5 Years Even with so much data showing home prices are actually rising in most of the country, there are still a lot of people who worry there will be another price crash in the immediate future. In fact, a recent survey from Fannie Mae shows tha

Read More

Boost Your Credit by Getting Your Rent Payments Reported!

How to get your rent reported to credit bureaus For many, rent is the largest monthly expense, and you can take steps to make sure your on-time rent payments are being reported to credit bureaus and helping you build credit. Building a credit history is crucial in today’s economy. It allows

Read More

Builder Incentives are Significant Right Now

New Homes May Have the Incentives You’re Looking for Today According to the U.S. Census Bureau, this year, builders are on pace to complete more than a million new homes in this country. If you’ve had trouble finding a home to buy over the past year, it may be time to work with your trusted agent

Read More

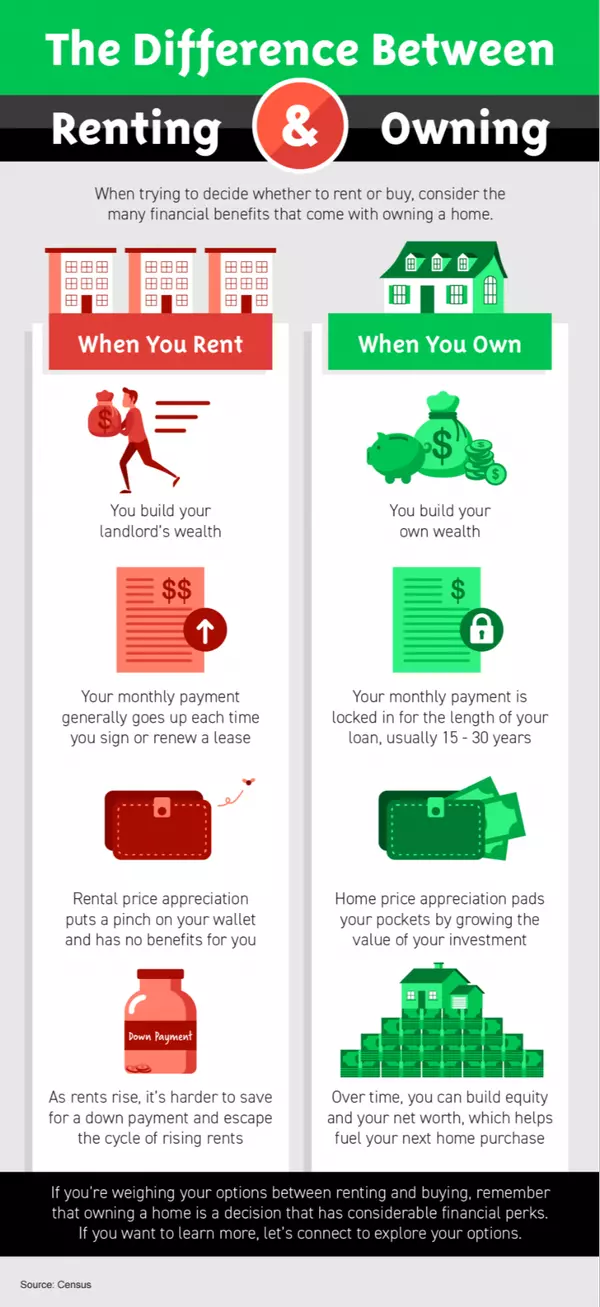

The Difference Between Renting and Owning

Read More

Recent Posts