Avoiding the Rent Trap in 2022

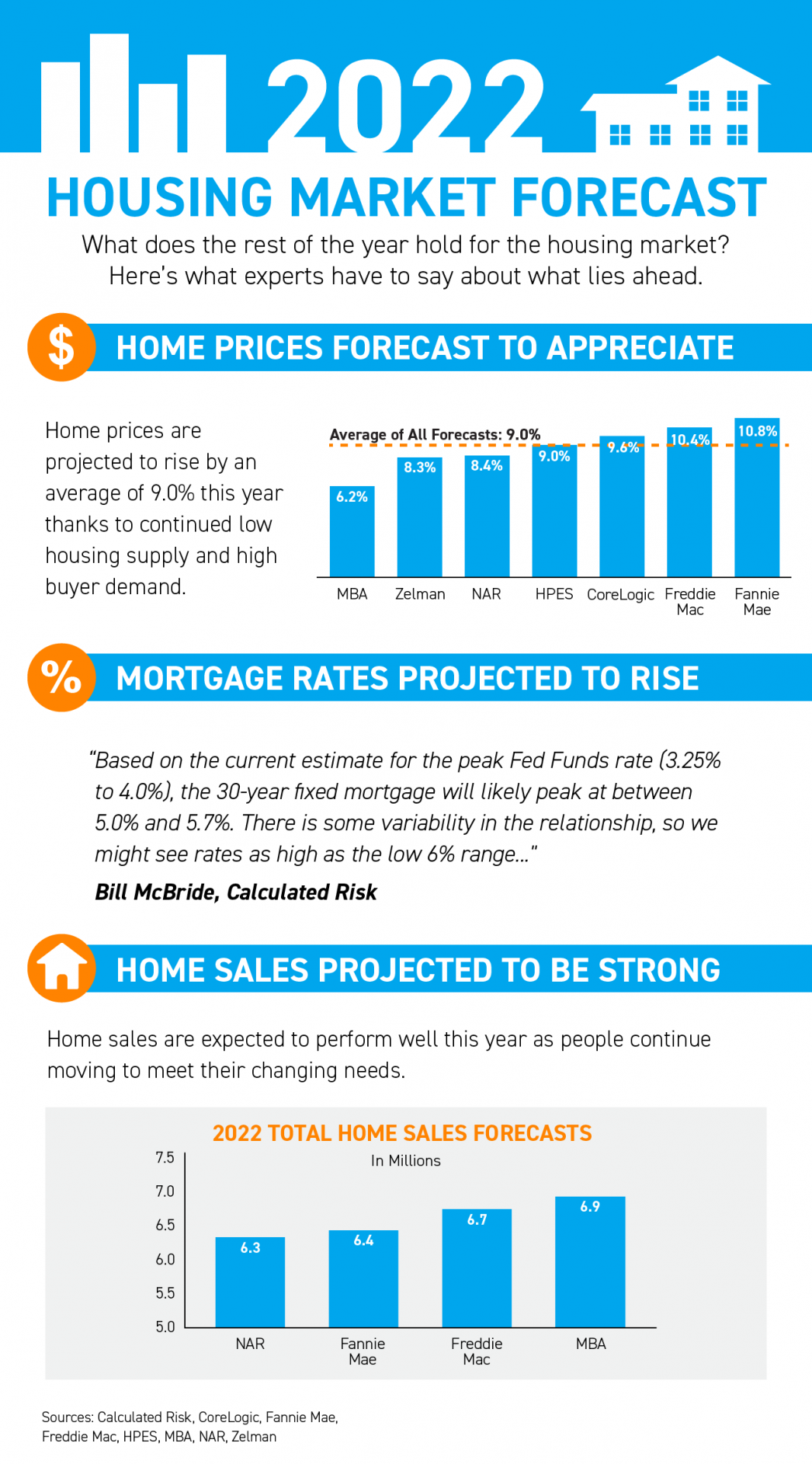

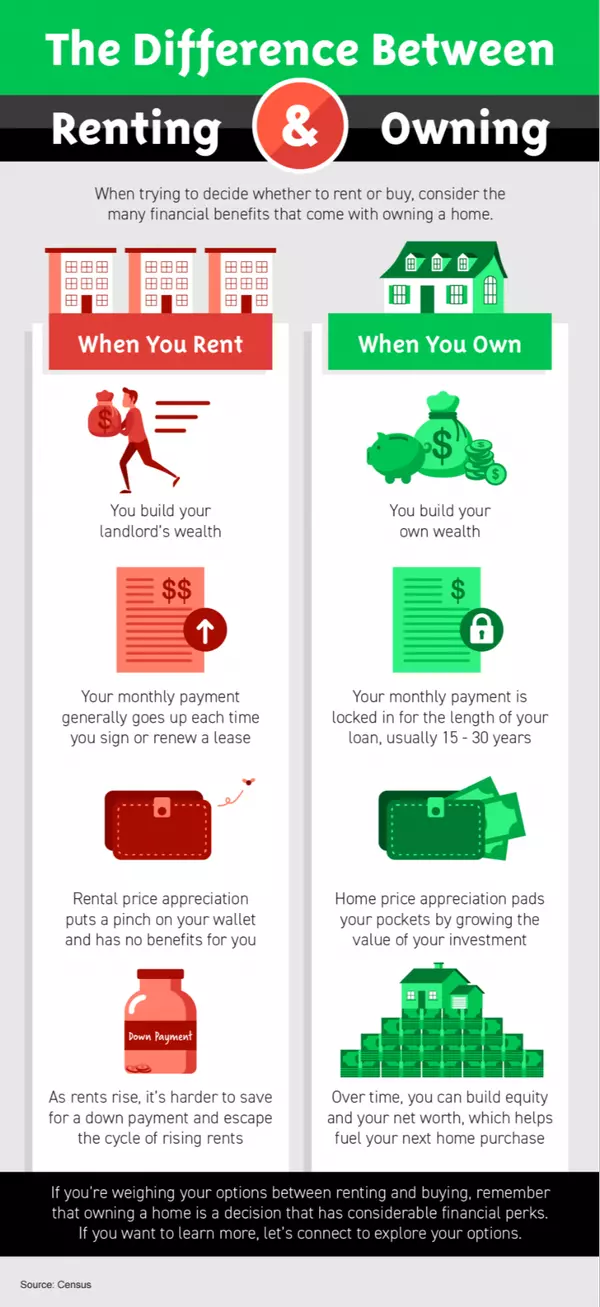

Are you one of the many renters thinking about where you’ll live the next time your lease is up? Before you decide whether to look for a new house or another apartment, it’s important to understand the true costs of renting in 2022. As a renter, you probably already know rents have been rising in th

Read More

Homeowners Insurance: What Is and Isn't Covered

Homeowners insurance is a must-have for anyone who owns a home. It can help you pay for damages for everything ranging from fire to theft. However, it is equally vital for you to understand what is in your policy and what is and isn’t covered. Homeowners insurance policies can vary from provider to

Read More

First Time Homebuyer Myths

Think you need 10% or 20% down to buy your first home? Nope. Not even close, if you meet certain guidelines. There are several programs in the Nashville area available to a single person with an annual income of up to $58,000. And other programs for a single who makes up to $96,000 and a couple who

Read More

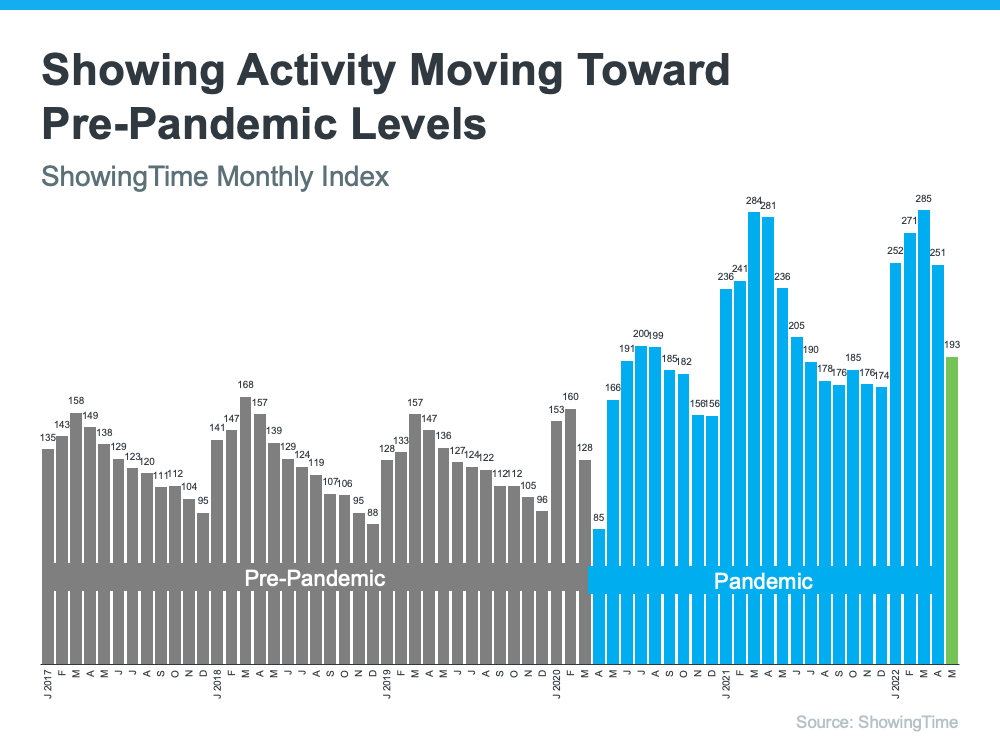

We're In a Seller's Market - What Does That Mean?

Whether or not you’ve been following the real estate industry lately, there’s a good chance you’ve heard we’re in a serious sellers’ market. But what does that really mean? And why are conditions today so good for people who want to list their house? It starts with the number of houses available for

Read More

Recent Posts